RBA waves white flag

This is pretty technical but might require us all to look at a future with rising interest rates, and it could happen sooner than expected.

The RBA met on Tuesday this week and decided to:

- Maintain the cash rate target at 10 basis points or 0.1%

- Continue the purchase of $4 billion of Government securities per week until mid February 2022

- Discontinue the yield target of 10 basis points for the April 2024 Australian Government bond

The Australian economy is recovering after the interruption caused by multiple COVID-19 outbreaks. As vaccination rates increase further and restrictions are eased, the economy is expected to bounce back relatively quickly. The central forecast is for GDP growth of 3 per cent over 2021 and 5½ per cent and 2½ per cent over the following two years. Bond yields have increased recently, and bond market volatility has also risen significantly.

The decision to discontinue the yield target reflects the improvement in the economy and the earlier-than-expected progress towards the inflation target. Given that other market interest rates have moved in response to the increased likelihood of higher inflation and lower unemployment, the effectiveness of the yield target in holding down the general structure of interest rates in Australia has diminished. This is code for the RBA reducing their influence and allowing the market to price in future interest rate increases and is likely to see fixed mortgage rates rise even further as banks price in an earlier official RBA interest rate rise.

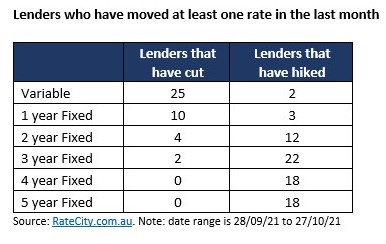

New Zealand, Norway, South Korea and Singapore recently lifted official interest rates, while the UK is considering a move as early as next month and the US Federal Reserve is expected to start withdrawing some stimulus later this year. In Australia, longer-term fixed-rate home loans are already becoming more expensive even though short-term or variable rates have been falling as shown in the table below.

The most recent figures from RateCity show that 18 lenders have increased their four and five-year fixed mortgage rates over the past month, while none have cut them, and 22 lenders have increased their three-year fixed mortgage rates, and 12 lenders have increased their two-year fixed rates. This suggests lenders are anticipating the RBA will start increasing the cash rate in two year’s time. The NAB has brought forward its forecast date of the first official rate rise to mid-2023, but it then predicts rates will climb quickly to 2% by the end of 2024. If passed on in full by lenders, such a rate increase would add about $500 a month onto the repayments for a $500,000 30-year mortgage.

This will obviously depend on whether the economy continues to grow and the rate of inflation, but it does show that the current low interest rates won’t stay low for much longer.

Sofie Korac is an Authorised Representative (No. 400164) of Prudentia Financial Planning Pty Ltd, AFSL 544118 and a member of the Association of Financial Advisers.

Financial Advice Sydney and the North Shore Office based in Gordon NSW