Market Volatility and Staying the Course

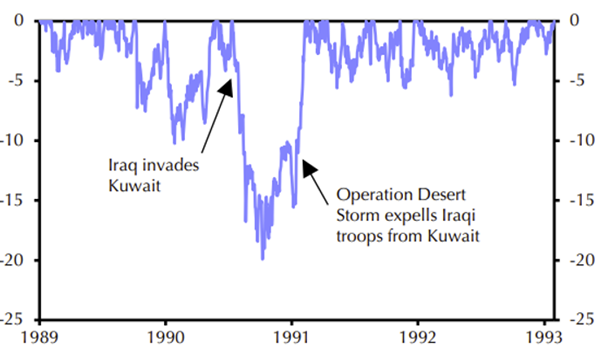

After several weeks of diplomatic tensions, over the last few days the word has watched in shock as Russia invades Ukraine. Geopolitical risks are difficult to predict and even more difficult to manage for within a portfolio context. In recent years we have seen growing tensions between China and the US, North Korea agitate, and ongoing conflicts in the Middle East, such as the Syrian conflict. Typically, markets tend to react sharply and quickly to geopolitical events. If we look at how markets reacted during the Gulf War in the early 90s when Iraq invaded Kuwait, the S&P 500 feel sharply but also recovered quickly. The chart below shows the drawdown from previous peak in the market. While every conflict is different, markets like certainty and a clear direction. Until that time, expect markets to be volatile.

S&P 500, Drawdown from previous peak (%)

Source: Capital Economics

As we see the Russia/Ukraine conflict escalate our expectation is that energy prices will continue to increase given Russia is a large oil and gas producer and Europe relies heavily on Russian energy. A significant development has been the move to block Russian banks from the SWIFT global payments system and freeze the Bank of Russia’s reserves which are expected to severely restrict movement of capital from Russia. We also saw the decision by Germany to suspend the Nord Stream 2 gas pipeline project, a gas pipe connecting Russian gas to Germany. This is significant because Germany essentially shut down its nuclear power stations opting for gas via the new Russian pipeline. It will be interesting to observe whether this will be a catalyst for Europe to rethink their energy sources to reduce their reliance on Russian gas.

(Source: lonsec.com.au)

As we have learned from previous

periods of volatility, it is important not to react emotionally in such periods

and focus on fundamentals. In periods of market volatility quality assets often

get oversold. During the last two years we have witnessed a record level of new

retail investors enter the market, as reflected by the surge in new online

share trading accounts being opened and for many this will be their first

encounter

with a market downturn. No doubt there will be some nervous investors.

We are monitoring the developments in the conflict and are assessing the potential impact on client portfolios. Portfolios remain well diversified and hold alternative and defensive assets such as infrastructure, short-duration fixed interest funds and cash to “weather the storm”.

Now is not the time to panic and to “stay the course”.

Sofie Korac is an Authorised Representative (No. 400164) of Prudentia Financial Planning Pty Ltd, AFSL 544118 and a member of the Association of Financial Advisers.

Financial Advice Sydney and the North Shore Office based in Gordon NSW