Investment and economic outlook, March 2024

Region-by-region economic outlook and latest forecasts for investment returns.

.

The U.S. economy has proved resilient despite Federal Reserve (The Fed) efforts to cool it to rein in inflation by keeping interest rates elevated, as noted in a recent commentary by Vanguard’s chief economist for the Americas, Roger Aliaga-Díaz. Given the economy’s continued strength and still-stubborn inflation, we believe that the Fed may not be in position to cut rates at all in 2024.

A continuation of U.S. economic exceptionalism

Better-than-expected workforce and productivity gains are behind the U.S. economy’s continued vigor. A combination of productivity growth of 2.7% and the addition of 3.5 million people to the workforce more than offset the effects of Fed monetary policy tightening in 2023. Household balance sheets bolstered by pandemic-related fiscal policy and a virtuous cycle where job growth, wages, and consumption fuel one another provide additional support.

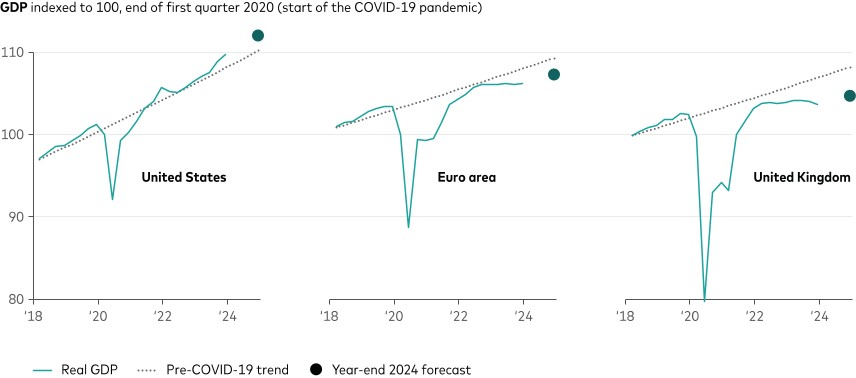

Although 2023 growth exceeded expectations in many other developed markets, none rivaled the United States’ above-trend growth. The following chart highlights the differences in GDP progressions among the U.S., the euro area, and the United Kingdom.

Growth remains above trend in the U.S. and below trend in the euro area and U.K.

Notes: The chart’s index real GDP to 100 at the first quarter of 2020 is for comparative purposes.

Sources: using data as of March 6, 2024, from the U.S. Bureau of Economic Analysis, Eurostat, and the U.K. Office for National Statistics.

Growth has been below the pre-COVID-19 trend in the euro area and the U.K., where productivity has waned and policy has become restrictive. We’ve lowered our forecasts for the year-end unemployment rate in both regions amid stronger-than-expected employment gains; however, falling job vacancies and shorter workweeks are gradually loosening labour markets in both regions.

The views below are those of the global economics and markets team of Investment Strategy Group as of 21 March, 2024.

Outlook for financial markets

Our 10-year annualised nominal return and volatility forecasts are shown below. They are based on the December 31, 2023. Equity returns reflect a 2-point range around the 50th percentile of the distribution of probable outcomes. Fixed income returns reflect a 1-point range around the 50th percentile. More extreme returns are possible.

Australian dollar investors

- Australian equities: 4.3%–6.3% (21.7% median volatility)

- Global equities ex-Australia (unhedged): 4.9%–6.9% (19.4%)

- Australian aggregate bonds: 3.7%–4.7% (5.5%)

- Global bonds ex-Australia (hedged): 3.9%–4.9% (4.8%)

Notes: These probabilistic return assumptions depend on current market conditions and, as such, may change over time.

Source: Investment Strategy Group as at 21 March 2024.

Important: The projections or other information generated by the Vanguard Capital Markets Model® regarding the likelihood of various investment outcomes are hypothetical in nature, do not reflect actual investment results, and are not guarantees of future results. Distribution of return outcomes from the VCMM are derived from 10,000 simulations for each modelled asset class in AUD. Simulations are as of 31 December 2023. Results from the model may vary with each use and over time.

Region-by-region outlook

Australia

The economy has shown modest signs of progress since the start of the year, primarily through consumption and business investment. We continue to expect that Australia will avoid recession in 2024, with economic growth below trend at around 1%.

- Recently, the key drivers of inflation have been domestic in nature. Productivity growth has been low, leaving unit labour costs growing at a rate above what would be consistent with the Reserve Bank of Australia’s (RBA) 2%–3% target. We foresee the pace of both headline and core inflation falling year-over-year to around 3% by the end of 2024.

- Noting that inflation remains elevated even as it continues to moderate, the RBA left its cash rate unchanged at 4.35% in March. Vanguard anticipates that the RBA will cut the cash rate to 3.85% by the end of 2024, and that the rate will eventually settle in a range of 3%–4%.

- We expect the unemployment rate to rise to around 4.6% by the end of 2024 as financial conditions tighten in an environment of elevated interest rates.

United States

At its last meeting on 20 March, the Fed left its federal funds rate target unchanged in a range of 5.25%–5.5%. The Fed increased its forecasts for real GDP growth and inflation.

- The economy expanded by 2.5% on an average annual inflation-adjusted basis in 2023, higher than the 1.9% increase registered in 2022. For 2024, we foresee growth of around 2%, higher than our initial growth estimate, in part because of the continued runway for consumer demand.

- The unemployment rate rose to 3.9% in February, up from 3.7% in January, but in our view the labour market remains on solid footing. We expect that labour supply strength and job growth will continue for a good part of 2024 before gradually subsiding and the unemployment rate ending 2024 at around 4%.

- Core inflation, as measured by the Personal Consumption Expenditures Price Index, edged down to 2.8% year over year in January from 2.9% in December. We continue to believe that the last mile to 2% inflation will remain challenging and that sticky services inflation will take time to unwind.

China

The economy is showing early signs of momentum toward what is likely to be an uneven recovery. Although supply-side factors such as industrial production and fixed asset investment recently exceeded consensus estimates, demand-side factors such as retail sales fell short of expectations.

- That supply-demand imbalance is just one factor that may make it difficult for China to reach its official economic growth target of “around 5%” for 2024. Other factors include persistent economic challenges stemming from an extended property downturn and base effects, or comparisons to year-earlier numbers, which will be higher this year.

- Consumer prices broke a four-month string of annual declines in February, but we don’t believe that spells the end for China’s recent dip into deflation. Rather, we attribute the higher prices in February to easy year-earlier comparisons. Lunar New Year holidays occurred in February this year; in 2023, they occurred in January.

- To mitigate deflationary pressure, we expect the People’s Bank of China to ease its policy rate from 2.5% to 2.2% in 2024 and to cut banks’ reserve requirement ratios.

Euro area

Although the euro area avoided falling into recession in the fourth quarter of 2023, we continue to expect 2024 growth in a below-trend range of 0.5%–1% amid still-restrictive monetary and fiscal policy and the lingering effects of Europe’s energy crisis on industry.

- We foresee the European Central Bank initiating a deposit facility rate-cutting cycle in June, with 25-basis-point cuts potentially at each of its final five 2024 policy meetings leading to a year-end range of 2.5%–3%. (A basis point is one-hundredth of a percentage point.)

- An upside surprise to initial inflation data for February effectively ruled out an April start to rate cuts. However, the confluence of moderating wage growth, inflation expectations that remain in check, and lackluster demand supports our expectation for headline inflation to fall to 2% by September 2024 and core inflation to reach that target by December.

- The labour market may be softer than the unemployment rate would suggest as job vacancy rates, though still high, have receded, labour hoarding remains elevated, and the number of hours worked has stagnated. We have downgraded our year-end 2024 unemployment rate forecast to 6.5%.

United Kingdom

The U.K. economy fell into recession in late 2023, but a monthly estimate for growth in January suggested the recession could be short. That said, we have lowered our forecast for economic growth to 0.3% for full-year 2024.

- The Bank of England (BOE) held the bank rate steady at 5.25% for a fifth consecutive meeting in March as it waits for further evidence that inflationary pressures are subsiding before beginning to cut. In our base case, we foresee a first policy rate cut in August, and a total of 100 basis points—or 1 percentage point—of cuts in 2024.

- Headline inflation slowed to 3.4% in February year over year, the smallest annual gain since September 2021. We foresee it falling to just below 2% by the end of 2024.

- The unemployment rate was 3.9% in the November–February period, marginally higher than in the preceding rolling three-month period. As in the euro area, the labour market’s gradual loosening appears mainly driven by soft factors such as reduced vacancies and fewer hours worked, rather than an increase in unemployment. As such we have lowered our year-end 2024 unemployment rate forecast to a range of 4%–4.5%.

Emerging markets

We continue to see GDP growth around 4% for global emerging markets in 2024, led by growth around 5% for emerging Asia. We anticipate growth in a range of 2%–2.5% for emerging Europe and Latin America, though our recent U.S. growth upgrade could signal positive implications for Mexico and all of Latin America.

- For Mexico, we are anticipating full-year 2024 economic growth of 1.5%–2%, core inflation falling to 3.6%–3.8% by year-end, and the overnight interbank rate being cut to 9%–9.5% by year-end.

Canada

Canada’s economy avoided recession in the fourth quarter of 2023, with greater-than-expected growth driven by exports and consumption. Although risks remain, we no longer foresee Canada falling into recession in the next three to six months. We continue to anticipate full-year 2024 growth of around 1%.

- As in the United States, we anticipate that the “last mile” of inflation reduction could be the most challenging. We continue to foresee core inflation falling to a year-over-year increase within the BOC’s target range of 2%–2.5% by the end of 2024, with house prices moderating in response to declining affordability.

- The Bank of Canada (BOC) held its overnight rate steady at 5.0% for a fifth straight meeting in March. However, we expect it to trim its overnight rate by 50 to 75 basis points this year, to a year-end range of 4.25%–4.5%.

- We foresee the unemployment rate rising to a range of 6%–6.5% in 2024 amid weak economic growth.

IMPORTANT: The projections and other information generated by the Vanguard Capital Markets Model® regarding the likelihood of various investment outcomes are hypothetical in nature, do not reflect actual investment results, and are not guarantees of future results. VCMM results will vary with each use and over time.

The VCMM projections are based on a statistical analysis of historical data. Future returns may behave differently from the historical patterns captured in the VCMM. More important, the VCMM may be underestimating extreme negative scenarios unobserved in the historical period on which the model estimation is based.

The Vanguard Capital Markets Model is a proprietary financial simulation tool developed and maintained by Vanguard’s primary investment research and advice teams. The model forecasts distributions of future returns for a wide array of broad asset classes. Those asset classes include U.S. and international equity markets, several maturities of the U.S. Treasury and corporate fixed income markets, international fixed income markets, U.S. money markets, commodities, and certain alternative investment strategies. The theoretical and empirical foundation for the Vanguard Capital Markets Model is that the returns of various asset classes reflect the compensation investors require for bearing different types of systematic risk (beta). At the core of the model are estimates of the dynamic statistical relationship between risk factors and asset returns, obtained from statistical analysis based on available monthly financial and economic data from as early as 1960. Using a system of estimated equations, the model then applies a Monte Carlo simulation method to project the estimated interrelationships among risk factors and asset classes as well as uncertainty and randomness over time. The model generates a large set of simulated outcomes for each asset class over several time horizons. Forecasts are obtained by computing measures of central tendency in these simulations. Results produced by the tool will vary with each use and over time.

This article contains certain ‘forward looking’ statements. Forward looking statements, opinions and estimates provided in this article are based on assumptions and contingencies which are subject to change without notice, as are statements about market and industry trends, which are based on interpretations of current market conditions. Forward-looking statements including projections, indications or guidance on future earnings or financial position and estimates are provided as a general guide only and should not be relied upon as an indication or guarantee of future performance. There can be no assurance that actual outcomes will not differ materially from these statements. To the full extent permitted by law, Vanguard Investments Australia Ltd (ABN 72 072 881 086 AFSL 227263) and its directors, officers, employees, advisers, agents and intermediaries disclaim any obligation or undertaking to release any updates or revisions to the information to reflect any change in expectations or assumptions.

Sofie Korac is an Authorised Representative (No. 400164) of Prudentia Financial Planning Pty Ltd, AFSL 544118 and a member of the Association of Financial Advisers.

Financial Advice Sydney and the North Shore Office based in Gordon NSW