Many Australians have a fear of running out

Longevity risk is a growing concern for many working Australians as well as retirees.

.

The fear of running out of money in retirement, also known as FORO, is certainly not a new phenomenon.

But Vanguard’s 2024 How Australia Retires research shows just how real, and prevalent, that fear is among many Australians who are still working, or who have already retired.

Of the more than 1,800 Australians aged 18 years and over who participated in the retirement research, which was conducted in March this year, almost one in two said they did not know whether their money will last in retirement.

There are a lot of factors feeding into this general fear, including the ongoing increases in average life expectancy rates for men and women.

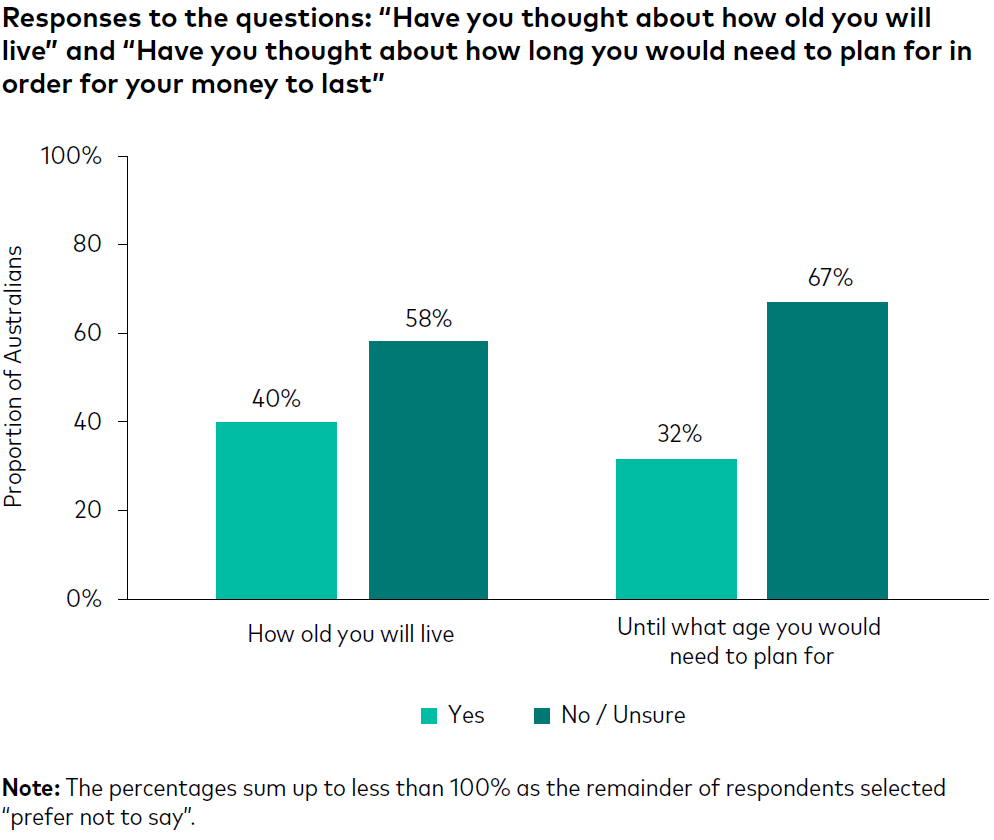

As part of the research, Vanguard asked respondents whether they had thoughts about how long they will live for, especially in retirement.

Vanguard believes that awareness of life expectancy and the possible length of retirement, although challenging to grasp for many, plays a crucial role in retirement planning.

As noted in the Intergenerational Report 2023, longevity risk (outliving one’s savings) is especially a key concern for retirees in deciding how to draw down their superannuation.

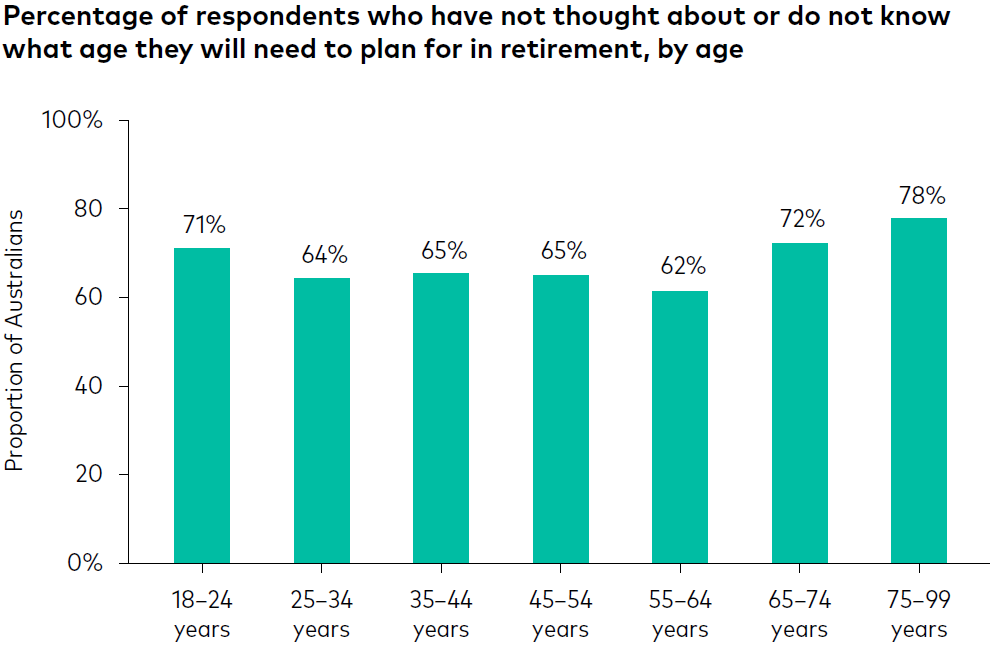

Of the 67% of Australians who have not thought about or don’t know what age they will need to financially plan for in terms of their retirement, many are in the older age brackets.

Vanguard’s research found this percentage is highest for those aged 65 to 74 years old (72%) and 75 to 99 years old (78%).

Almost three in five retirees believe they have a 40% or greater likelihood of outliving their retirement savings. Additionally, almost one in five retirees believe they are at significant risk, with a perceived 90% or greater likelihood of running out.

Perhaps more concerningly, one in two retirees do not know how much they can spend each year in order to not outlive their savings.

Concerns over rising living costs

Retirees are particularly concerned about their ongoing living costs, particularly in the current economic environment where costs have surged due to higher inflation.

Cost of living was front of mind for many retirees this year, with median minimum income needs in retirement increasing from the $30,000-40,000 per year range in 2023 to $40,000-50,000 per year by March 2024.

Indeed, 42% of retirees reported a worse household financial position compared to 12 months ago. Of this cohort, 96% believe rising living costs had a negative impact (large or slight) on their household’s financial position.

While 14% of all respondents think their minimum income needs will be the same every year in retirement, the majority (70%) of all respondents believe their retirement income needs will vary.

Predicting spending needs in retirement (and then planning accordingly) can be difficult as it involves a series of decisions, including when to transition to retirement, how to manage different sources of passive income, and then ultimately, how much to draw down in retirement income each year to accommodate desired lifestyles without running out of money.

For the 34% of retirees who have an account-based pension with a superannuation fund, the majority (59%) only withdrew the minimum amount required by the Government. When asked why, 70% believed the minimum is enough, 20% cited not wanting to run out of money in the future and 6% did so thinking of the minimum amount requirement as Government advice.

Not just a retiree concern

The fear of running out of money in retirement is not just a concern for retirees, it’s also a fear for many people who are still working and saving up for their retirement.

Vanguard’s research found that four in five working-age Australians believe they have a 40% or greater likelihood of outliving their savings in retirement.

At best, this means that Australians are generally uncertain whether they will have enough money for retirement.

At worst, it could mean they feel they are highly unlikely to maintain an acceptable lifestyle, even with the Age Pension and any other Government support for which they may be eligible.

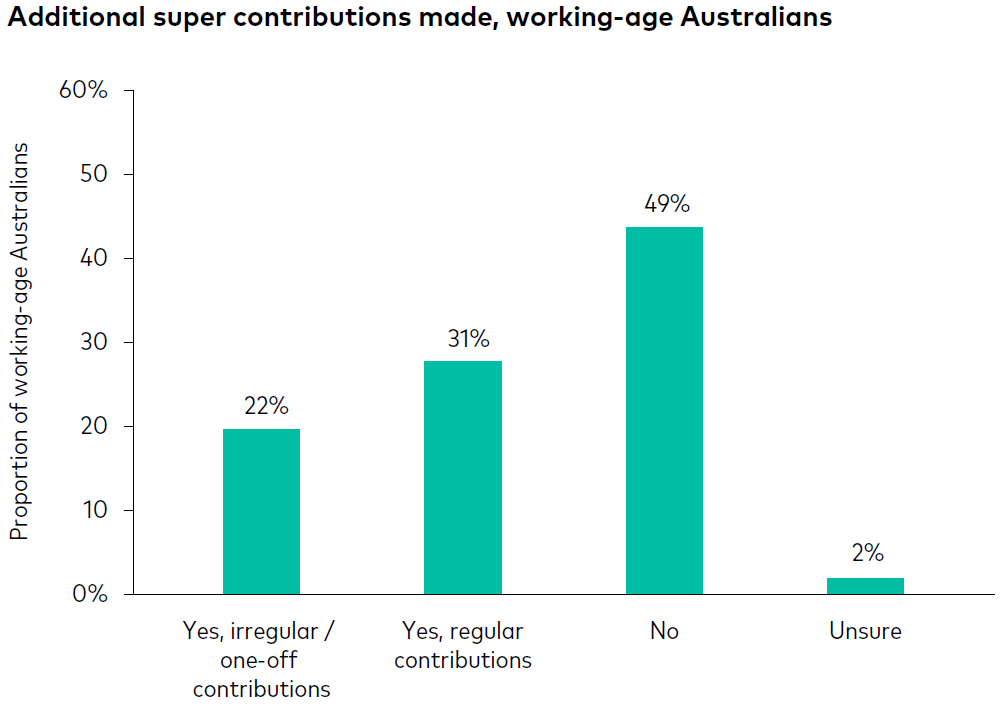

Of course, saving ahead for retirement, leveraging Australia’s compulsory superannuation regime and, where possible, making additional personal concessional (before-tax) and non-concessional (after-tax) super contributions along the way is fundamental to mitigating longevity risk.

Alarmingly, the How Australia Retires research found almost half of working-age Australians had not made any personal contributions to their superannuation, and more than a quarter had no plans to make future personal contributions as part of their retirement plan.

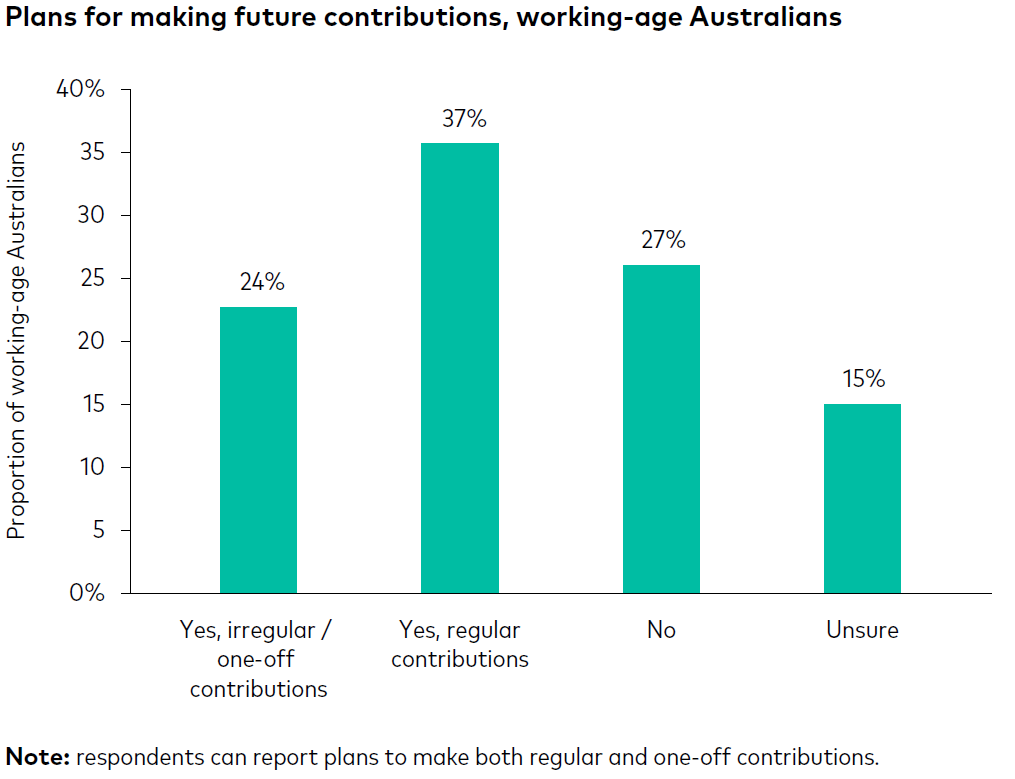

Positively, however, more than half of working-age Australians are open to making additional contributions in the future, with 37% willing to make regular contributions and 24% willing to make irregular or one-off contributions.

There is hope with younger generations. Encouragingly, Gen Z and Millennial working-age Australians are the most open to the possibility of contributing additional super in the future (63% and 69% respectively). Almost half of Gen X working-age Australians (49%) would consider future additional contributions.

JUNE 2024

Tony Kaye, Senior Personal Finance Writer

vanguard.com.au

Sofie Korac is an Authorised Representative (No. 400164) of Prudentia Financial Planning Pty Ltd, AFSL 544118 and a member of the Association of Financial Advisers.

Financial Advice Sydney and the North Shore Office based in Gordon NSW