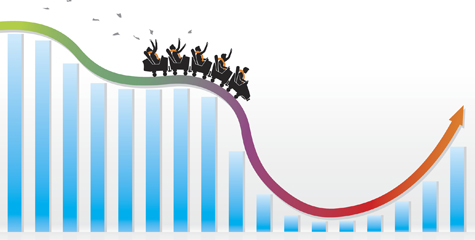

Record-breaking crash, rapid rebound …

Is this a recovery or “dead cat bounce”?

Covid-19 sparked the fastest stock market crash on record, when the Dow Jones Industrial Average index of US stocks (‘the Dow’) fell by over 30% in only 25 trading days from 6 February.

Even in the Great Depression, it took almost twice as long to fall this far.

Past Performance is not a guide to future performance and may not be repeated.

Source: Samuel H. Williamson, ‘Daily Closing Value of the Dow Jones Average, 1885 to Present,’ MeasuringWorth, 2020, and Schroders. Analysis based on changes in the price level of the Dow Jones Industrial average, as there is not a long enough history of daily total return data.

The second act in this unfolding drama has been a phenomenal rally. At one stage, the Dow was up by almost 30% from its 23 March trough. Some of the biggest companies in the world are back trading at all-time highs.

This begs the question of whether financial markets have turned a corner, even as the human impact of Covid-19 continues to be deeply troubling?

The current situation is unique, and we have never seen monetary and fiscal support on such a scale and at such a speed before.

However, many aspects of human behaviour which influence markets in the short-term are timeless. Fear and pessimism, and greed and optimism, have played prominent roles through the ages. As a result, analysis of how investors and markets have behaved in the aftermath of historic crashes can provide useful insights into how they might behave this time around. And give clues as to how likely it is that the stock market has really turned a corner…

Analysis of 135 years of data

To read the analysis by the team at Schroder, click here.

Sofie Korac is an Authorised Representative (No. 400164) of Prudentia Financial Planning Pty Ltd, AFSL 544118 and a member of the Association of Financial Advisers.

Financial Advice Sydney and the North Shore Office based in Gordon NSW